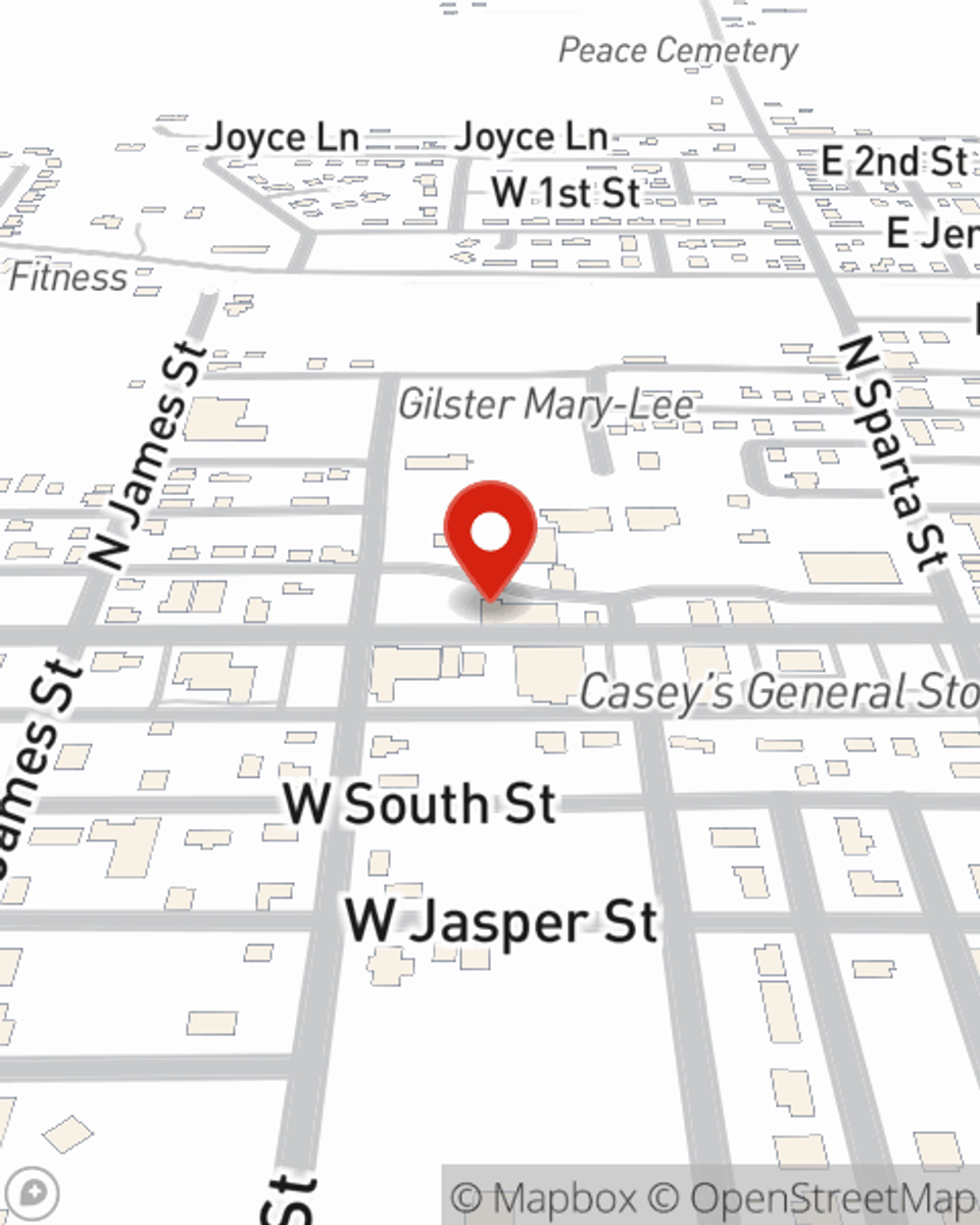

Business Insurance in and around Steeleville

Researching coverage for your business? Look no further than State Farm agent Terrin Thies!

Almost 100 years of helping small businesses

Insure The Business You've Built.

Whether you own a a home improvement store, a flower shop, or a clock shop, State Farm has small business protection that can help. That way, amid all the various decisions and options, you can focus on making this adventure a success.

Researching coverage for your business? Look no further than State Farm agent Terrin Thies!

Almost 100 years of helping small businesses

Protect Your Business With State Farm

When one is as committed to their small business as you are, it makes sense to want to make sure all systems are a go. That's why State Farm has coverage options for artisan and service contractors, surety and fidelity bonds, commercial liability umbrella policies, and more.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Terrin Thies's team to explore the options specifically available to you!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Terrin Thies

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".